The Green loan is our way of supporting the efforts of Armenian MSMEs to develop environmentally friendly and socially responsible businesses. Because these investments are not only aimed at business development, but also address the environmental problems we face today, Green loans are offered at preferential conditions by the partner financial institutions (PFIs).

The PFIs are responsible for the financial analysis and the final decision vis-à-vis the disbursement of green loans. You can apply for a Green loan directly from the participating green financing.

Terms and conditions:

| Feature | Information |

| Loan purpose | Green investments (fixed assets, working capital) in accordance with the so-called 70/30 rule |

| Currency | AMD |

| Green loan amount | AMD 1bn |

| Loan maturity | ≤ 60 months |

| Interest rate | defined by PFIs |

| Collateral requirements | defined by PFIs |

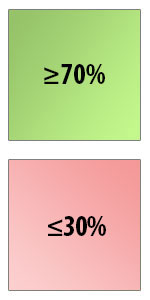

70/30 rule:

At least 70% of the Green loan amount must be used to purchase machinery, equipment, or other goods and products, including services and other incidental expenses related to the planned green investment. Eligible incidental services and other incidental expenses may be summarised as follows:

At least 70% of the Green loan amount must be used to purchase machinery, equipment, or other goods and products, including services and other incidental expenses related to the planned green investment. Eligible incidental services and other incidental expenses may be summarised as follows:

- Installation costs (including preparation costs)

- Costs for necessary additional equipment directly linked to the investment

- Costs for technical feasibility checks

- Labour costs directly linked to the investment

Up to a maximum of 30% of the Green loan amount may be spent on other fixed asset purposes.